Middleware

Harness the Power of Middleware with Our Oracle Solutions

Drive Business Transformation with Oracle Business Process Management (BPM)

Discover the transformative power of the Oracle Business Process Management Suite (Oracle BPM Suite). As one of the most comprehensive solutions in the market, it offers unmatched efficiency, visibility, and agility for a wide range of business processes. Whether you're addressing a line-of-business need or embarking on an IT systems integration initiative, the Oracle BPM Suite provides the perfect balance of business flexibility and IT power. With egabiFSI, your organization can reap the benefits of an agile and flexible platform, built on your existing applications, ready to adapt swiftly to new business needs while boosting productivity. Our development methodology embraces and applies SOA & BPM concepts, making complex application development and integrations a thing of the past. Expect agile, reusable, service-based applications that quicken your market response, fulfill business requirements faster, and lower costs.

Unleash the Potential of Oracle SOA

Many enterprises hold vast data reserves in legacy Enterprise Information Systems (EIS), making it impractical to discard these valuable assets. Instead, the smart move is to evolve and enhance EIS in a cost-effective manner, and Service-Oriented Architecture (SOA) provides the perfect solution. SOA is the premier integration and architectural framework in today's diverse computing environment, unlike previous attempts that relied on proprietary APIs and necessitated extensive group coordination. SOA enables you to streamline processes, improving business efficiency, and agility to meet changing needs and competition. It's the key to unlocking the potential of Software-As-A-Service. At egabiFSI, we excel in designing and developing integration applications and crafting the overall architecture using various Oracle SOA technologies.

Request a demo or find out more about How can we reinforce your bank or financial institution operations.

Related Services

Discover our most popular articles

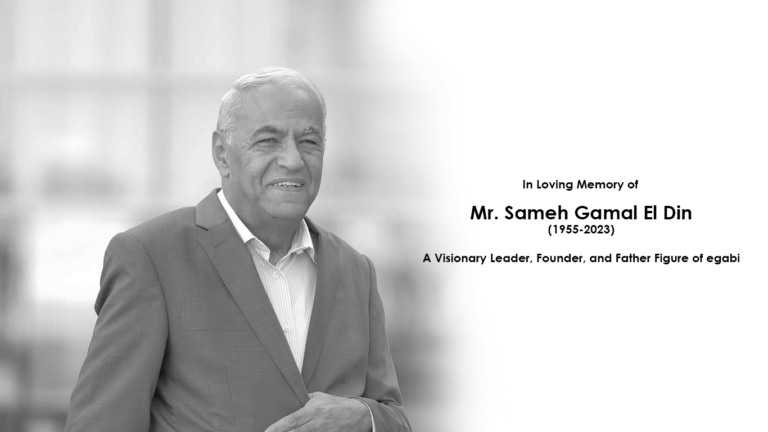

Remembering Mr. Sameh Gamal El Din (1955-2023): A Visionary Leader, Founder, and Father Figure of egabi

In Loving Memory of Mr. Sameh Gamal El Din (1955-2023): Visionary Leader, Founder, and Father Figure of egabi We extend our deepest condolences to the family and colleagues of Sameh (1955-2023), a remarkable leader, founder, and father figure of egabi,

Join us at the Seamless Exhibition, New Cairo – A New Era of FinTech Begins!

egabiFSI To Showcase Innovations at the Seamless Exhibition – New Cairo, Egypt We’re excited to announce that egabiFSI will be exhibiting at the Seamless Exhibition for North Africa and the Middle East. This prestigious event, taking place from July 17-18,

Leap Forward with egabifFSI Academy: Creating Fintech Professionals of the Future

Bridging academia and fintech with hands-on programs. In a world where financial technology continues to evolve rapidly, Egabifsi Academy, an innovative arm of our leading Fintech company, pioneers in educating and equipping fresh graduates with relevant industry skills. To date,

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa The transformation of the SMEs market in Egypt, spearheaded by top fintech companies, is part of a larger wave sweeping

egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets

2023 egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets egabi FSI, a leading IT banking solutions provider, has partnered with global payment technology company Mastercard to expand access to cutting-edge digital lending solutions across emerging markets.

How Neo Banks and Digital Banks are Enhancing and Brightening the Future of Traditional Banking

Financial institutions face all sorts of risk. From credit to liquidity, trading to operations, banks open their doors each day to potential losses if something goes wrong.