OFSAA Suite

Unleash the Power of Financial Analytics with Our OFSAA Services

Discover the power of advanced financial analytics with our Oracle Financial Services Analytical Applications (OFSAA) services. Whether it's launching new products through incisive profit/loss analysis, bolstering profitability via detailed asset/liability management, or expanding market share through customer profitability analysis, OFSAA provides the tools you need for success.

Our solutions don't just provide analytical insights; they optimize your decision-making processes. Simulate different scenarios, conduct comprehensive multivariate estimations, simplify external reporting, and even boost your credit rating, all with OFSAA.

Here at egabiFSI, we combine our expertise in the financial and banking industry with in-depth knowledge of Oracle's Financial Services. We offer analytical solutions that not only support your financial decision-making but enhance performance evaluation across departments, products, and customers.

Improve risk management processes, streamline budgeting, and make your planning more effective with OFSAA's versatile functional modules. From financial data management and real-time transfer pricing to activity analysis, risk management, budgeting, and planning, egabiFSI makes harnessing the full power of OFSAA easier than ever before.

In retail banking, so many different campaigns and activities go into customer engagement, from online marketing to in-branch promotional campaigns. Each of the steps in the marketing mix has their objectives, but also need to be evaluated throughout the entire marketing program. With Oracle Financial Services Customer Insight for retail banking, Chief Marketing Officers finally can gain a 360o view of the customer. With this enterprise-wide view of the customer, banks now have key insights into the customer lifecycle within the organization. Traditionally, the customer is evaluated in data silos throughout multiple channels, but with on-demand reports and dashboards, senior management is empowered to analyze customer engagement from beginning to end.

The Oracle Financial Services Data Foundation provides a single source through a common staging and integrated results area. The foundation stages data directly from source systems processes the data and provides results in easy-to-read dashboards giving the CFO suite the confidence in the data quality and helping them speed up the financial close process. Offering a predefined physical data model for data sourcing and reporting the Oracle FSDF is the essential building block for any financial organizations’ single-source of Truth and cornerstone for any DWH initiative. egabiFSI’s extensive functional and technical expertise uniquely positioned to offer true value add services to banks through implementing the OFSDF to maximize their data/information potential allowing them to reuse data for multiple analytical use cases and various management and regulatory reporting needs as well as enables consistency, transparency, and auditability across all analytical domains.

The Oracle Financial Services Data Foundation provides a single source through a common staging and integrated results area. The foundation stages data directly from source systems processes the data and provides results in easy-to-read dashboards giving the CFO suite the confidence in the data quality and helping them speed up the financial close process. Offering a predefined physical data model for data sourcing and reporting the Oracle FSDF is the essential building block for any financial organizations’ single-source of Truth and cornerstone for any DWH initiative. egabiFSI’s extensive functional and technical expertise uniquely positioned to offer true value add services to banks through implementing the OFSDF to maximize their data/information potential allowing them to reuse data for multiple analytical use cases and various management and regulatory reporting needs as well as enables consistency, transparency, and audit-ability across all analytical domains.

Oracle ALM Analytics provides a rich and robust solution that empowers a bank with adaptive, actionable insights. OALMBI integrates data from disparate systems across the organization to provide a comprehensive view of interest rate risk across multiple dimensions. The application delivers relevant information to meet the needs of all the roles responsible for risk management in the organization, enabling banks to manage interest rate and liquidity risk effectively in rapidly changing market conditions.

Management (ALM), helps financial services institutions measure and monitor Interest Rate Risk, Liquidity Risk, and Foreign Currency Risk. This solution measures and models every loan, deposit, investment, and portfolio individually, using both deterministic and stochastic methods. Oracle Financial Services ALM is a next-generation solution fully integrated with Oracle’s Financial Services Analytical Applications and shares a common account level relational data model.

Oracle Profitability Analytics – Companies across the financial services industry are finding greater business Intelligence a key strategic differentiator as they face off against their competitors, and, more importantly, as they implement strategies to acquire and retain customers while optimizing their value. Profitability Business Intelligence is central to these strategies, and yet still usually leveraged only at the corporate level, by key banking executives who use the information for top-level decisions. While it’s strategically necessary for top executives to know the profitability of their customers, it’s critical to make this information also accessible to the front office, branch employees, and call center representatives to better support intelligent operational decisions.

Oracle Financial Services Profitability Management enables financial services institutions to calculate profitability information by-products, channels, segments, and even individual customers. Standard profitability calculations may be adjusted for risk to enable Risk-Adjusted Performance Management (RAPM), an imperative for financial services institutions operating in this rapidly evolving and complex industry. Oracle Financial Services Profitability Management is a next-generation solution that is fully integrated with Oracle’s Financial Services Analytical Applications and shares a common customer account level relational data model.

Oracle Financial Services Funds Transfer Pricing is the industry’s first matched maturity funds transfer pricing application, which lets financial institutions determine the spread earned on assets and liabilities, and the spread earned as a result of interest rate exposure for each customer relationship. egabiFSI tailors this solution, enabling accurate assessment of profitability along with product, channel, and business lines, as well as the centralization of interest rate risk, so that risk can be effectively managed.

Liquidity Risk Solution empowers financial institutions to comprehensively address liquidity risk at a global enterprise level. The solution drives multi-jurisdictional compliance by addressing continuously changing regulatory guidelines. It lays out a flexible stress testing framework with inbuilt counterbalancing capabilities to facilitate the most optimal usage of the bank’s reserves.

OFSAA Liquidity Risk Management gives banks the ability to aggregate enterprise data in a single location in real-time, thus reducing the uncertainty around data reliability, accuracy, and timeliness. With the preconfigured regulatory scenarios, rules, and computations that address the liquidity ratio guidelines of the US Federal Reserve, RBI, EBA, and BIS, this application helps achieve on-time regulatory compliance. In addition to the ratios (LCR/ NSFR), the solution addresses deposit insurance, intraday liquidity metrics, and jurisdiction-specific liquidity measures to provide an integrated solution for Liquidity Regulation compliance.

Request a demo or find out more about How can we reinforce your bank or financial institution operations.

Discover our most popular articles

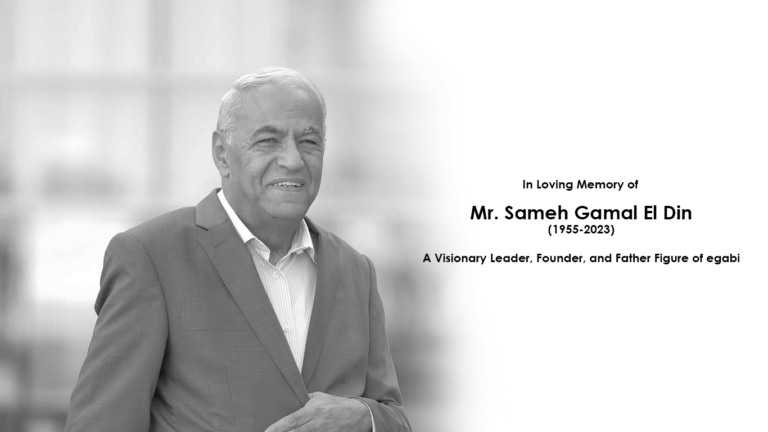

Remembering Mr. Sameh Gamal El Din (1955-2023): A Visionary Leader, Founder, and Father Figure of egabi

In Loving Memory of Mr. Sameh Gamal El Din (1955-2023): Visionary Leader, Founder, and Father Figure of egabi We extend our deepest condolences to the family and colleagues of Sameh (1955-2023), a remarkable leader, founder, and father figure of egabi,

Join us at the Seamless Exhibition, New Cairo – A New Era of FinTech Begins!

egabiFSI To Showcase Innovations at the Seamless Exhibition – New Cairo, Egypt We’re excited to announce that egabiFSI will be exhibiting at the Seamless Exhibition for North Africa and the Middle East. This prestigious event, taking place from July 17-18,

Leap Forward with egabifFSI Academy: Creating Fintech Professionals of the Future

Bridging academia and fintech with hands-on programs. In a world where financial technology continues to evolve rapidly, Egabifsi Academy, an innovative arm of our leading Fintech company, pioneers in educating and equipping fresh graduates with relevant industry skills. To date,

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa The transformation of the SMEs market in Egypt, spearheaded by top fintech companies, is part of a larger wave sweeping

egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets

2023 egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets egabi FSI, a leading IT banking solutions provider, has partnered with global payment technology company Mastercard to expand access to cutting-edge digital lending solutions across emerging markets.

How Neo Banks and Digital Banks are Enhancing and Brightening the Future of Traditional Banking

Financial institutions face all sorts of risk. From credit to liquidity, trading to operations, banks open their doors each day to potential losses if something goes wrong.