MOBILEPLUS

MOBILEPLUS: Elevating User Experience in Banking to Unprecedented Heights

In an era where smartphones reign supreme and instant solutions are the order of the day, MOBILEPLUS emerges as a beacon of transformation in the banking landscape. Offering a secure and user-friendly mobile banking and payment solution for both retail and corporate banking customers, MOBILEPLUS bridges the gap between technology and convenience. Whether you're an Android aficionado or an iOS enthusiast, MOBILEPLUS has you covered.

This cutting-edge software harmoniously integrates with multiple back-end operational systems, offering a seamless experience that places control squarely in the user's hands. The moment you step into the world of MOBILEPLUS, you step into a realm of enriched capabilities and services that extend beyond conventional banking paradigms.

Banking is no longer confined to the four walls of a branch or the constraints of business hours. With MOBILEPLUS, customers have the liberty to conduct financial transactions, manage accounts, and access a suite of banking services anytime, anywhere, right from the comfort of their smartphones. From making payments and transferring funds to tracking account activity and more, the possibilities are endless.

MOBILEPLUS doesn’t just transform the way customers interact with their banks, but also the way banks approach their business. Equipped with MOBILEPLUS, banks gain a distinctive competitive edge in the modern banking marketplace. They can deliver personalized, immediate, and exceptional services, enhancing customer satisfaction and, in turn, loyalty.

In essence, MOBILEPLUS personifies the perfect amalgamation of user experience, simplicity, and immediacy. It is an embodiment of the future of banking - a future that's secure, accessible, and incredibly user-centric.

Deliver Improved Customer Service

Seamless Integration Across Back-End Operational Systems

Increased Cost Savings

Request a demo or find out more about How can we reinforce your bank or financial institution operations.

Discover our most popular articles

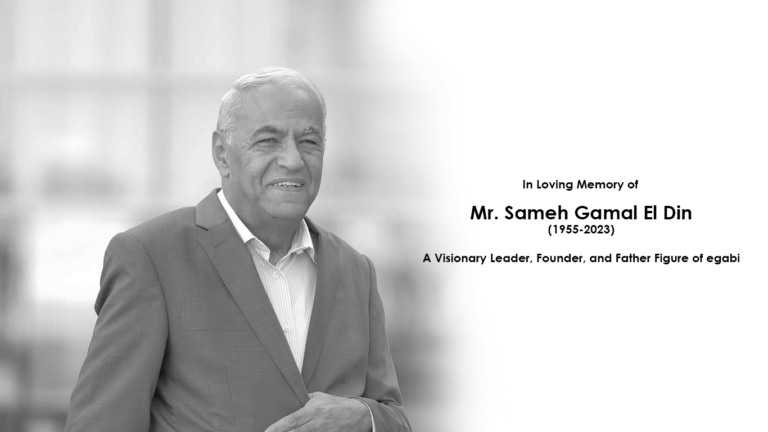

Remembering Mr. Sameh Gamal El Din (1955-2023): A Visionary Leader, Founder, and Father Figure of egabi

In Loving Memory of Mr. Sameh Gamal El Din (1955-2023): Visionary Leader, Founder, and Father Figure of egabi We extend our deepest condolences to the family and colleagues of Sameh (1955-2023), a remarkable leader, founder, and father figure of egabi,

Join us at the Seamless Exhibition, New Cairo – A New Era of FinTech Begins!

egabiFSI To Showcase Innovations at the Seamless Exhibition – New Cairo, Egypt We’re excited to announce that egabiFSI will be exhibiting at the Seamless Exhibition for North Africa and the Middle East. This prestigious event, taking place from July 17-18,

Leap Forward with egabifFSI Academy: Creating Fintech Professionals of the Future

Bridging academia and fintech with hands-on programs. In a world where financial technology continues to evolve rapidly, Egabifsi Academy, an innovative arm of our leading Fintech company, pioneers in educating and equipping fresh graduates with relevant industry skills. To date,

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa The transformation of the SMEs market in Egypt, spearheaded by top fintech companies, is part of a larger wave sweeping

egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets

2023 egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets egabi FSI, a leading IT banking solutions provider, has partnered with global payment technology company Mastercard to expand access to cutting-edge digital lending solutions across emerging markets.

How Neo Banks and Digital Banks are Enhancing and Brightening the Future of Traditional Banking

Financial institutions face all sorts of risk. From credit to liquidity, trading to operations, banks open their doors each day to potential losses if something goes wrong.