CHATBOTPLUS

CHATBOTPLUS: Transforming Customer Interaction in the Digital Age

In today's hyper-connected world, where instant gratification is the norm, CHATBOTPLUS is a game-changer, revolutionizing the way financial institutions interact with their customers. Chatbots, or artificial intelligence (AI) powered virtual assistants, are taking the world of social media marketing by storm. They are not just engaging consumers through content consumption and customer service, but also facilitating transactional engagements seamlessly.

With their lightning-fast response times and the ability to offer personalized solutions, chatbots like CHATBOTPLUS are redefining customer experiences. These intelligent virtual assistants are available round the clock, offering consistent, quick, and efficient problem-solving capabilities before the need for human intervention arises.

Whether it's responding to customer inquiries, providing account updates, or assisting with transactions, CHATBOTPLUS is capable of handling a wide array of tasks. The beauty of CHATBOTPLUS lies in its ability to interact in a natural language, such as English or Arabic, thereby breaking down linguistic barriers and facilitating smoother communication.

With the advent of voice bots, this experience has become even more interactive. Customers can simply speak their queries or commands, and the voice bots, equipped with advanced speech recognition and natural language processing abilities, will handle the rest.

For financial institutions, the benefits are immense. CHATBOTPLUS not only improves efficiency and customer satisfaction, but also opens up a whole new channel for customer acquisition and retention. By offering personalized, engaging, and real-time interaction, financial institutions can build stronger relationships with their customers, fostering trust and loyalty.

In the face of evolving customer expectations and increasing competition, CHATBOTPLUS is not just a valuable asset but a necessity. It is the future of customer interaction, ready to transform the financial sector, one conversation at a time.

Reduce Inquiry/Response Time (Up to 90% Increase in ART )

Increased Customer Satisfaction (Up to 50%)

Higher Cross-Selling & Up-Selling Opportunities

Request a demo or find out more about How can we reinforce your bank or financial institution operations.

Discover our most popular articles

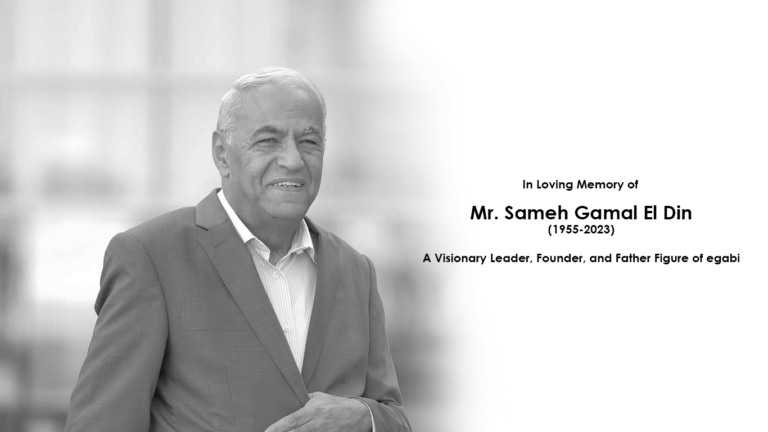

Remembering Mr. Sameh Gamal El Din (1955-2023): A Visionary Leader, Founder, and Father Figure of egabi

In Loving Memory of Mr. Sameh Gamal El Din (1955-2023): Visionary Leader, Founder, and Father Figure of egabi We extend our deepest condolences to the family and colleagues of Sameh (1955-2023), a remarkable leader, founder, and father figure of egabi,

Join us at the Seamless Exhibition, New Cairo – A New Era of FinTech Begins!

egabiFSI To Showcase Innovations at the Seamless Exhibition – New Cairo, Egypt We’re excited to announce that egabiFSI will be exhibiting at the Seamless Exhibition for North Africa and the Middle East. This prestigious event, taking place from July 17-18,

Leap Forward with egabifFSI Academy: Creating Fintech Professionals of the Future

Bridging academia and fintech with hands-on programs. In a world where financial technology continues to evolve rapidly, Egabifsi Academy, an innovative arm of our leading Fintech company, pioneers in educating and equipping fresh graduates with relevant industry skills. To date,

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa

The Best Fintech Companies Revolutionizing Microfinance and SMEs in Egypt and the Promising Future of the SMEs Market in Africa The transformation of the SMEs market in Egypt, spearheaded by top fintech companies, is part of a larger wave sweeping

egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets

2023 egabiFSI and Mastercard Collaborate to Drive Digital Lending Solutions in Emerging Markets egabi FSI, a leading IT banking solutions provider, has partnered with global payment technology company Mastercard to expand access to cutting-edge digital lending solutions across emerging markets.

How Neo Banks and Digital Banks are Enhancing and Brightening the Future of Traditional Banking

Financial institutions face all sorts of risk. From credit to liquidity, trading to operations, banks open their doors each day to potential losses if something goes wrong.